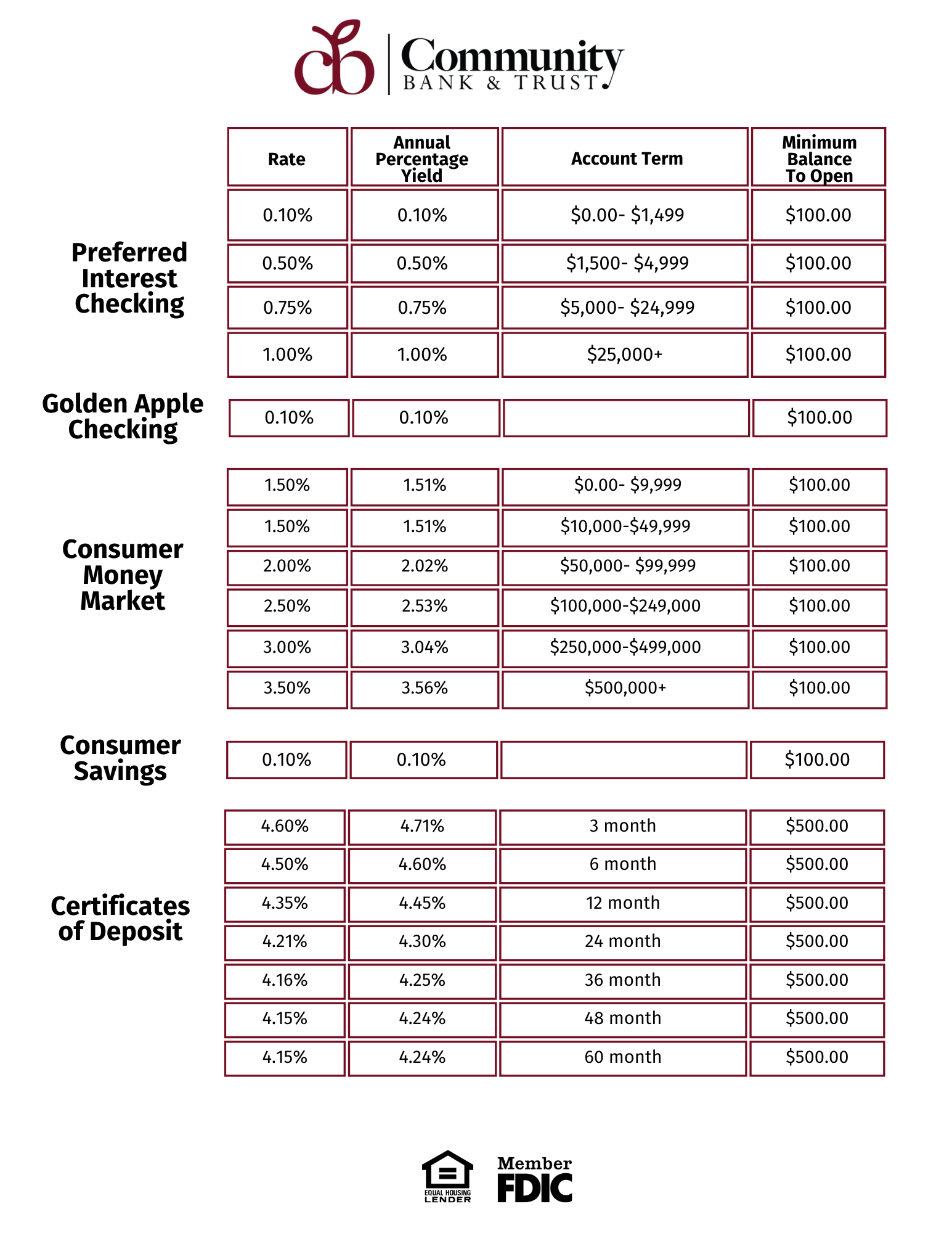

Preferred Interest Checking

The interest rate and annual percentage yield (APY) may change after the account opening. Fees could reduce earnings on the account. The interest rate listed in each tier will be paid on the entire balance in your account. Interest will be compounded monthly and will be credited to the account monthly. If you close your account before interest is credited, you will receive the accrued interest.

Golden Apple Checking

The interest rate and annual percentage yield (APY) may change after the account opening. Fees could reduce earnings on the account. Interest will be compounded monthly and will be credited to the account monthly. If you close your account before interest is credited, you will receive the accrued interest.

Money Market

The interest rates and annual percentage yield (APY) may change after the account opening. Fees could reduce earnings on the account. The interest rate listed in each tier will be paid on the entire balance in your account. Interest will be compounded monthly and will be credited to the account monthly. If you close your account before interest is credited, you will receive the accrued interest. A service fee of $10.00 will be imposed every statement cycle if the daily balance in the account falls below $1000.00 on any day of the statement cycle.

Consumer Savings

The interest rate and annual percentage yield (APY) may change after the account opening. Fees could reduce earnings on the account. Interest will be compounded quarterly and will be credited to the account quarterly. If you close your account before interest is credited, you will receive the accrued interest.

Certificate of Deposits

Early Withdrawal Provisions: We may impose a penalty if you withdraw any of the funds before the maturity date. The penalty imposed is based upon the terms of your Certificate of Deposit. Less than one month all accrued interest, one year or less 1-month. Greater than 1-year, 3-months interest. Compounding and Crediting: Interest will be compounded daily and will be added back to the certificate at maturity. The APY assumes interest will remain on deposit until maturity. A withdrawal will reduce earnings. If interest is credited to another account or paid to you by check, this may reduce earnings and may negate the effect of interest compounding.